04 December

The revival of the sales in Q2 2020 of more than 15% in Norway raised some eyebrows. Certainly because the other Nordics experienced only a 5% – 6% recovery. In other European countries the percentages also were far lower. To analyse the risks to value investments in real estate more insights in the human factor will be needed. It is necessary to predict the impact of developments in society on the real estate portfolio. DISCvision produced a short overview of the Nordics within a NW European real estate context from psychological and cultural perspectives. We share some general findings concerning the Nordic countries.

The DISC lifestyle model predicts the preferred behavioural and communication style of an individual. The model is combined with the index of cultural differences of professor Hofstede (Cultures Consequences) and the World Value Survey. The different cultures are positioned within the DISC lifestyle model. The merger of these insights is described in our joint publication with the the Hague Centre of Strategic Studies (HCSS) “Towards Post-Corona Leadership” (www.discvision.nl/wp-content/uploads/2020/10/Divided-We-Stand-final-pdf-HCSS.pdf). We refer to this document to elaborate on the methodology of our analyses.

The Nordic countries we include are Norway, Sweden, Finland and Denmark. A lot of investors compare these four countries in their investment schemes. At first sight, certainly from a American perspective, they are more or less one group.

The Nordic countries are more or less in one group towards:

The Nordic countries are more or less in one group towards:

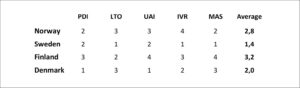

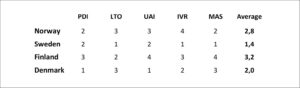

- Small power difference and easy access to leaders (PDI-index)

- Freedom of human drives and deciding yourself (IVR- index)

- Feminine and preference towards quality of life (MAS-index)

The differences are growing if we look at the cultural preferences in:

The differences are growing if we look at the cultural preferences in:

- Respect for tradition Sweden performing more towards more pragmatism (LTO-index)

- Relatively less avoidance of risks by Sweden which is now joined by Denmark (UAI-index)

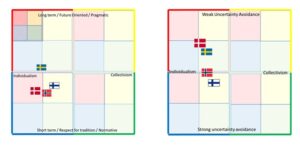

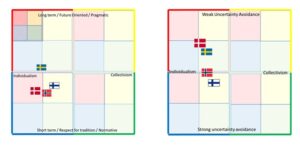

From a European perspective ‘however’ we are quite sensitive to the strength of local cultural differences. We therefore take a closer look to the countries from a cultural perspective. The opposite position on the horizontal bar, the X-dimension, is formed by Individualism versus Collectivism (IDV-index) of Hofstede. In the table we rank 1-4 the four countries against their position to the X-dimension.

The cultural lifestyle perspective shows a larger difference between the countries than it seems to be at first sight. Freedom of behaviour ‘for instance’ is noticeably different between Sweden and Norway. Norway being relatively more restraint and normative. The social behaviour norms in Norway (sexual intercourse age, bribing, lying, incorrect financial information) are extremely strict and in line with the normative culture on these issues.

All four cultures of these countries are in the red quarter of the DISC profile. They can easily be seen by other cultures to be dominant, moralistic and may be even arrogant and just doing things on their own terms. These cultures will be seen to be risk-takers, extremely goal-oriented and competitive. The population of Denmark seems to be most outspoken. Whereas in other NW European countries advancement, earnings, challenges, recognition and use of skills are considered more important. Freedom, personal time, training and health conditions are more important in Norway and Sweden.

The other NW European countries, especially Great Britain and The Netherlands, should be very careful with the Nordic cultural traditions and rituals. These will not be replaced quickly by new ideas. This is applicable to all Nordic cultures, especially Norway. The sensitivity to stress elements is more volatile to the young democracies. The fact that Norway has been a unified democracy only since 1905 may be still important on a cultural level. (Sweden and Norway used to be one union within the reign of the Swedish king). This difference between Norway and Sweden will be felt in business. Norwegians tend to do more research to be sure before taking decisions. Whereas Denmark and Sweden stand out in taking in risks.

The preference of Norwegian consumers of the use of regional (Nordics) and local Norwegian) products will be an important factor in the relatively strong recovery of the Covid-19 dip in retail sales. In many European countries a sales revival was measured in Q2. The 15,8 % rise in Norway was of a different category to Europe and also to the other Nordic countries that experienced only figures between the 5% – 6%. Oxford Economics warns that the local relatively small Nordic economies will be hit by the expected negative developments due to Covid-19 crisis throughout Europe in Q4. They expect a new dip and don’t expect recovery before the midst of 2021.

The Nordic countries are more or less in one group towards:

The Nordic countries are more or less in one group towards: The differences are growing if we look at the cultural preferences in:

The differences are growing if we look at the cultural preferences in: