16 November

How changes in consumer behaviour becoming structural may impact property

What was feared by many became reality by the end of November. Many parts in Europe including the Netherlands and its neighbouring countries are back in lockdown, either full or partial. Was the first lockdown still an incident following a health crisis, following the lessons learned of the first lockdown, the second lockdown emphasises possibly on more structural changes.

What are choices consumers will face in the post-Covid period in terms of living, working, shopping, and socialising? What decisions will fade away over time and what changes in behaviour are there to stay? Evidence of past pandemics like the Spanish Flue show that pandemics tend to result in a changed set of rules of the game. What is this going to imply for property investment? Aspects these questions touch on include:

- In retail, the changing role of stores. How the inter-relationship between online sales channels and physical channels will change?

- For offices, will we return to a ‘nine-to-five’ use pattern of workplaces? Or will homeworking become more widely accepted? And how will that impact the need for office space as well the conceptual design of workplaces?

- Will urbanisation continue the way it did before Covid? For people working and living, dense central areas in big cities turned out to be less effective and attractive. Will this be a trigger for suburbanisation? Or will compact mid-size cities become more attractive?

Following the start of the first Covid-lockdown in March, the impact was dramatic and 2020 Q2 became a shock, like a reset, to the economy as well as to the real estate market as many aspects of production and consumption stopped simultaneously.

In the real estate market, the impact of the first lockdown was mainly felt in the retail asset class, as shops and gastronomy had to close. Retail rent collection rates went down dramatically in the UK and across Europe with governments encouraging landlords and tenants to come to a compromise. But, in sharp contrast with the general trend, supermarkets and convenience retail assets have been performing well. Residential and logistics turned out to be resilient. With online trade growth accelerating, logistic facilities are in even higher demand than before. Despite massive home working, most companies have been sticking to their offices so far, with very diverse scenario’s on how the post-Covid office will look like.

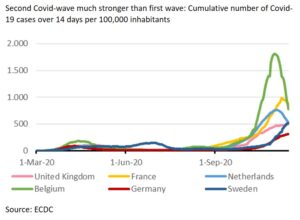

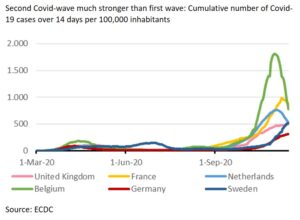

With lockdown measures lifted gradually as of May, summer 2020 showed a significant rebound, business and consumer confidence rebounded. Returning holiday makers and pupils back to school resulted in an increase of new Covid- cases. Initially quite gradual, but rapidly accelerating as of October with daylight becoming shorter and outside temperatures edging down.

With lockdown measures lifted gradually as of May, summer 2020 showed a significant rebound, business and consumer confidence rebounded. Returning holiday makers and pupils back to school resulted in an increase of new Covid- cases. Initially quite gradual, but rapidly accelerating as of October with daylight becoming shorter and outside temperatures edging down.

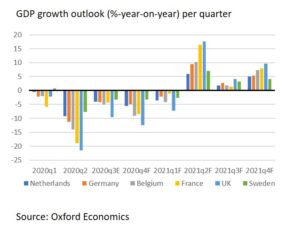

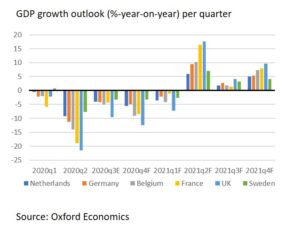

Back in a partial lockdown in most of Europe, it is apparent that the initial Q3 recovery will not continue in Q4. Though the health systems seem to be better able to handle the current wave, the lockdown-measures are more carefully tailored, and the economy is better prepared to handle lockdown measures, Q4 is likely to be another setback, albeit probably not as dramatic as Q2.

Revised economic forecasts by various organisations including the EU and Oxford Economics indicate a discontinuation of the rebound in Q4 and a delayed and more moderate recovery in 2021. GDP reaching pre-Covid levels is likely to be pushed back into 2023.

What does this imply for the real estate market? While investment transactions took a dive in Q2 and Q3, yields have been holding up relatively well so far, except in the retail and hotel asset classes. These have been the most severely asset classes so far, linked to lockdown-related limitations and travel bans. While Covid has acted as accelerator for ongoing trends in the retail sector to result in an increasing demand for repurposing retail assets, Covid came as a surprise for the hotel asset class which was going through a period of growth. While the impact of Covid on retail is expected to be long term, the hotel asset class has potential to recover in the mid-long term. Logistics and residential are most resilient so far. Residential rent collections continue to be high as tenants tend to prioritise payment of rent, and with logistics in high demand, collection rates tend to be high. Views on the outlook of the workplace in the future and the way that will impact the office market remain unclear. However, as ULI and PWC indicated in their Emerging Trends in Real Estate in Europe 2021 report, a majority of CEO’s expect to see more remote working a lower need for office space.

But a view post-Covid trends seem to appear. First, neighbourhood proximity and convenience locations have been performing relatively well so far. Not only for retail, but also for workplaces. In this way, commuters can avoid potentially unsafe commutes. Second, while prime continued to be preferred, anything else have been under pressures, further polarising the market. And third, flexibility became even more important. Not only in terms of time, but also in terms of functions. For instance, a swap from retail into services, or a coffee house used as a workspace. Aggerating and translating this into real estate, the importance of mixed-use is to grow further, with an increase ability to shift between functions. Owners, users, and public authorities must be prepared for this.

While the depth of the Covid-impact and the way to a future normalisation remain unclear, Covid is accelerating ongoing transitions in the real estate sector. Retail repurposing, an increased need for flexibility, and a greater emphasis on quality public space are just a few of them.

For investors and developers, having knowledge in what degree user’s behaviour will show a structural change in the post-Covid- times is essential to define their strategy and conceptualise their projects. Understanding consumer behaviour will be essential to be define post-Covid real estate strategies, because it is the end-user which defines the success of an asset.

- How will the consumer look at shopping and marketplaces? What will be criteria for them to visit these places? How will that affect the setup and hierarchy of retail locations?

- How will employees, especially those who can work remote, organise their work time? How will employers accommodate the hybrid working possibilities? What role will offices play and how will this affect preferred business locations?

- And what will be residential priorities for people? An increased need for space and air ventilation? Will people prefer space over density and explore to live further away from central urban areas?

Real estate is already undergoing a shift from space provision to service provision. The need for more flexibility will be accelerated by Covid, as will the demand for space promoting health and wellbeing.

Following this introducing, we will be touching on how Covid is to affect different aspects of real estate via changed behaviour and demands of consumers in follow-up pieces in our blog.

Herman Kok

+31653999026 / +447710083347

herman.kok@discvision.nl

With lockdown measures lifted gradually as of May, summer 2020 showed a significant rebound, business and consumer confidence rebounded. Returning holiday makers and pupils back to school resulted in an increase of new Covid- cases. Initially quite gradual, but rapidly accelerating as of October with daylight becoming shorter and outside temperatures edging down.

With lockdown measures lifted gradually as of May, summer 2020 showed a significant rebound, business and consumer confidence rebounded. Returning holiday makers and pupils back to school resulted in an increase of new Covid- cases. Initially quite gradual, but rapidly accelerating as of October with daylight becoming shorter and outside temperatures edging down.